Get Your Financial Health Back in Shape

Discover a range of tactics to effectively manage concentrated stock, balancing market risks with tax considerations.

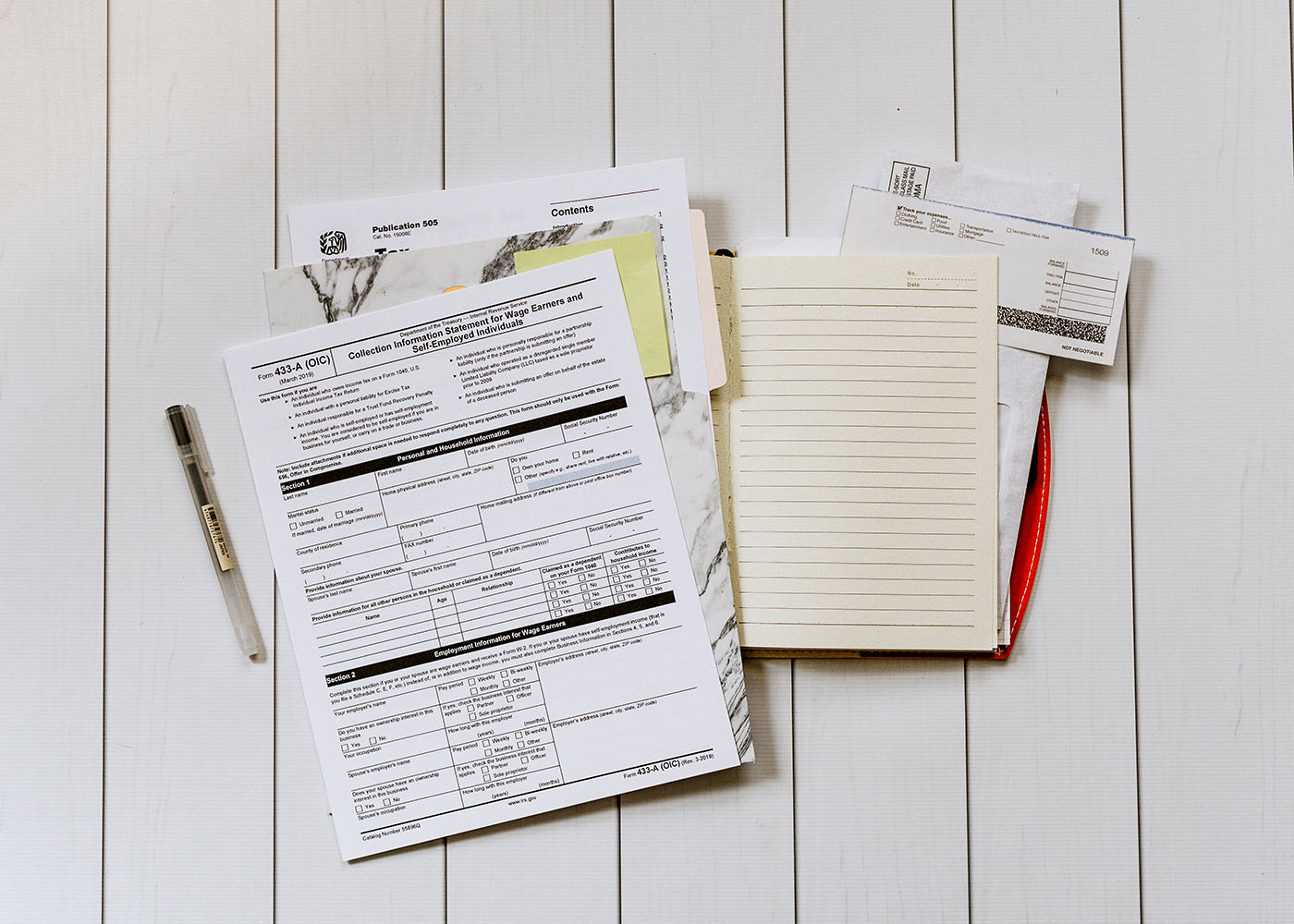

The Corporate Transparency Act brings new reporting requirements for businesses. Find out who has to report, what the deadlines are, and other important information about the CTA.

Just because you don’t expect your estate to be subject to federal taxes doesn’t mean you should skip estate planning. Learn strategies to enhance your family’s financial future and reduce tax liabilities.

In pursuing wealth, people often set a number at which they expect to feel rich. But many continue feeling discontent despite reaching that milestone. This article examines why money doesn’t always dispel feelings of financial insecurity.

Understanding ESOPs: Learn the basics, debunk the myths, and navigate the IRS scrutiny that comes with this corporate structure.

In a wealthy family’s portfolio, life insurance can play the role of a bond-like investment, potentially offering tax benefits, predictable returns, and a protective barrier against market volatility.

Learn the essential steps to prepare your business or medical practice for sale, from planning your exit strategy to assembling a negotiation team.

Minimize the tax impact of capital gains with these strategies to keep more of your hard-earned money.

Implementing these strategies may help to reduce your tax burden in the face of proposed tax increases.

When you’re ready to sell your business or practice, take these steps to position it for the highest possible value.

While not a replacement for professional advice, this overview of the common business entities can help you choose the right one for your new business.

The IRS has recently released retirement contribution limits. Here’s a rundown of the numbers.

Before the year ends, consider putting these tax planning opportunities to work to help you lower your tax burden.

Emotions can be useful, but they can also get you in trouble. As an investor, fear can cause you to make mistakes. Learning to put them in the proper perspective can help.

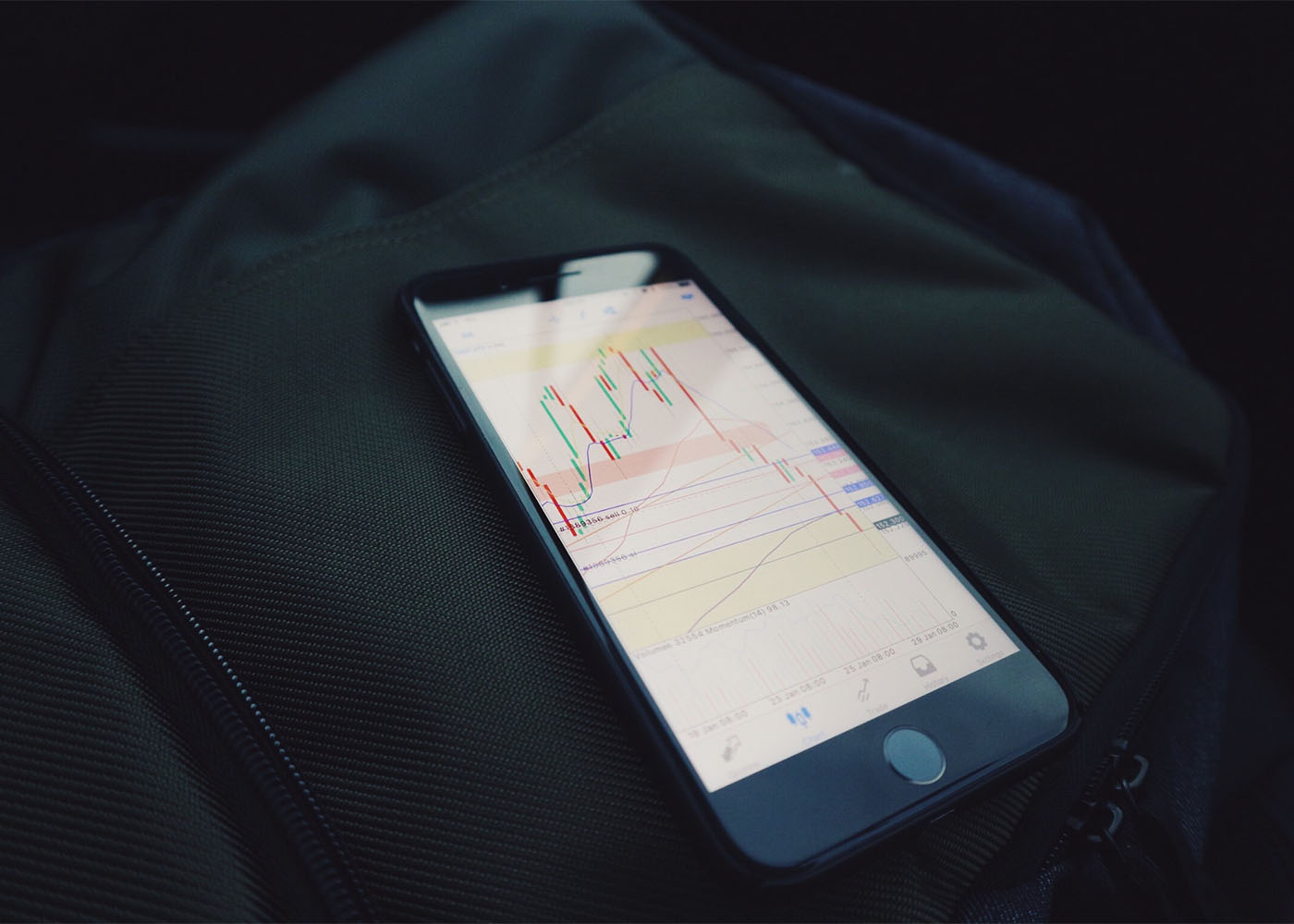

Jumping in and out of the market could cause a difficult year for your portfolio to become a tragic year for your portfolio.

In this open Q&A webinar session, Chris Roe answers questions he received from participants about investing, tax planning, inflation, and more.

In a recent Florida legal case, a debtor’s IRA assets were ruled to be fair game to creditors. Learn why and what you can do to protect your own IRA.

As a new physician, you face different challenges than other professionals when it comes to building wealth. These 11 strategies can help.

When considering becoming an independent contract physician, there are several common myths that doctors tend to buy into.

What do your beliefs about how wealthy individuals spend their money say about your own spending habits? The answer might surprise you.

As a practice-owning physician, what a great opportunity you have to employ your child in your practice! Employment helps develop life skills, such as responsibility, work ethic, and money management, while simultaneously providing you with some income tax benefits.

From student loans to business startup costs, it’s expensive to become a doctor and run your own practice. Realizing the full return on your investment often takes time. So if you are struggling to decide whether to focus on paying debt down aggressively or investing more money for the future, you’re not alone.

As an independent contractor physician, you take on the responsibility of taxes, insurance, and more - but the advantages often make it worthwhile.

There’s a major retirement plan issue many physician business owners overlook. Be sure you understand these rules about controlled groups and retirement plans.

Asking for a prenuptial agreement can be frowned upon, but it’s really an opportunity to negotiate your marriage contract without the stress and emotional turmoil of divorce.

Have you considered that you might not be in the retirement plan that gives you the best benefit? As an independent contract physician, you need to think about and plan for your own retirement. Because of your time in medical school, you naturally got a later start at building wealth than other professionals.

Are you worried that Biden’s tax plan will get passed by Congress? If not, you should be, as most physicians will see their take-home earnings decrease significantly.

Chris Roe, CPA, PFS was recently awarded the Five Star Wealth Manager Award for outstanding service by Five Star Professional, a Minnesota-based market research company. This is his seventh time receiving the award, which is granted annually.

As a physician seeking to create wealth, there are some important points you should consider while focusing on long-term investing and goals.

Advanced planning using the right framework is the key for physicians to grow their wealth and achieve their goals.

Many advisors start their interaction with potential clients by asking about their goals. But while understanding a client’s goals is essential when forging a long-term relationship, it is not the critical first step.

Tax season can be stressful. Keep things simple with this 2021 tax season to-do list.

Capital gains taxes apply to more than stocks. And the amount you pay will depend on a variety of factors. Here's how capital gains taxes work and a few methods you can use for reducing them.

The CARES Act was passed nearly eight months ago, but there's one benefit you may have overlooked. As you give to your favorite organizations this holiday season, keep this important change in mind.

As a doctor, there are specific financial concerns you face. From paying back thousands in student loan debt to finding the right financial partner, here are 5 key components that should make up your financial plan.

$192,000... No it's not the price of a home, it's how much debt medical students graduate with on average. If you're a doctor looking to tackle your student loan debt and other financial goals, here are a few things to look for when searching for an advisor.

As a physician, are you thinking about having children? A kid will set you back around $233,000. Is it better to make that financial commitment now or later?

College is an exciting time but it's also a time for learning, learning how to budget. Help your college-bound children learn the importance of finance with these 4 tips.

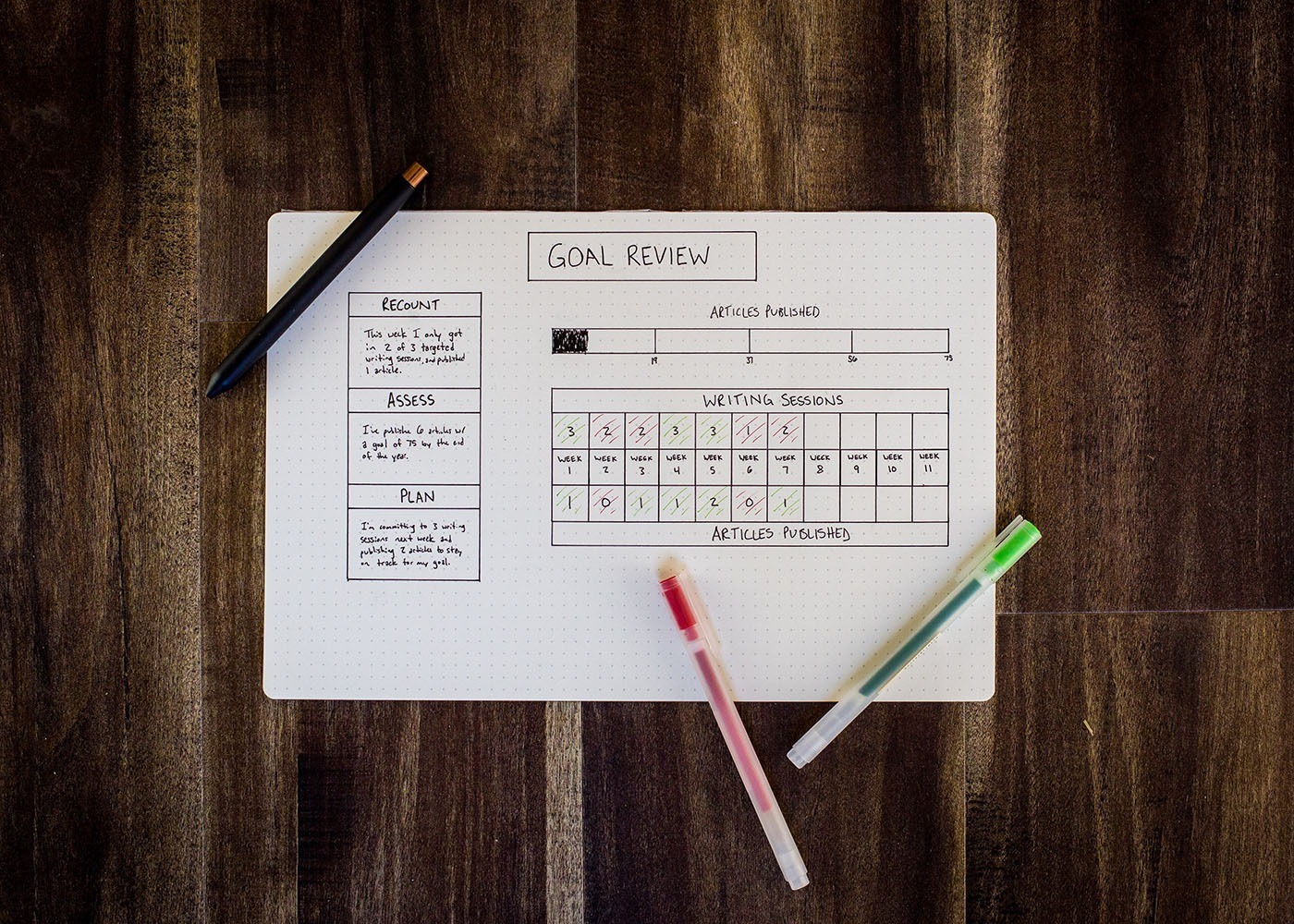

Physicians, you are 42% more likely to achieve your goals by simply writing them down. Learn this and 7 more tips to achieving even your hardest goals.

Many investors commit what Rx Wealth calls the 7 Cardinal Sins of Investing. Are you one of them? You should familiarize yourself with these investment sins in order to avoid.

In recent months, doctors have experienced major events that will change the complexion of their 2020 taxes. Make sure to spend time planning your 2020 taxes as you surely do not want to miss out on the many tax savings opportunities and overpay tax.

As a physician, your family's needs and assets are critical considerations when determining how much life insurance to invest in. Use this four step process to help you calculate how much life insurance you need.

Physicians are taking time during the COVID-19 crisis to update their finances and important life documents. Here are four estate plan details a physician should focus on in light of the current pandemic.

Did you receive a Paycheck Protection Program Loan? The SBA recently released the forgiveness application. Here are the important highlights for businesses and self-employed individuals.

Are you an independent contract physician or self-employed? We get it, taxes can be daunting. Here's the lowdown on the most common (and valuable) tax deductions freelancers should be aware of.

You did not get a Paycheck Protection Loan from the SBA. All hope is not lost. Here are 3 benefits you may be eligible to obtain in these rough economic times.

The average mortgage rate has fallen to an all time low, prompting a wave of refinancing activity. You still have time to evaluate if refinancing make sense for you and to lock in a low rate.

The recent market downturn can be a beneficial opportunity for doctors. Should you be taking advantage of today's bear market? We'll help make your decision easier with these 5 considerations to use as your GPS.

As a physician, there are important benefits under the new CARES Act that may help through these difficult times. We outlines 5 important areas.

The past month has been very scary. As a doctor, the disruption to your daily lives, careers and finances has been monumental. But what if someone said to you, “There is always a silver lining”. How would you respond? Opportunities generally present themselves when adversity hits. Do you want to be the one that misses opportunities? Consider these 4 actions for your 401K.

If someone were to say, “it’s time to hire a financial advisor, how would you respond? Maybe it doesn’t seem necessary. Or, maybe you’d feel overwhelmed at the thought of working with someone on your financial life. If so, you’re not alone. But let’s talk about 3 surprising reasons why hiring a financial advisor (aka a financial coach) might be the best thing you ever did for your practice and your personal life.

Have you ever wondered if you’re making a big investment mistake (without even knowing it)? Deep breaths. Hopefully you’re not. But whether you’re new to investing or you’ve been in the game for a while, I’d like to talk to you about how to avoid some common mistakes I’ve seen in my 22 years as a financial professional.