By Chris J. Roe, CPA, PFS

As a practice-owning physician, what a great opportunity you have to employ your child in your practice! Employment helps develop life skills, such as responsibility, work ethic, and money management, while simultaneously providing you with some income tax benefits.

But before you run out and hire your child, there are a few things you need to know.

Staying Within the Law

In Pennsylvania, a minor must be 14 years old to be employed. Additionally, the child needs to obtain a work permit. Each state has its own child labor laws and hours that minors can work during the school year, so be sure to speak to an employment attorney or accountant to ensure state law compliance.

After ensuring compliance with state law, you need your child to do actual work within your practice—not be a ghost employee—to get paid. Develop a job description and use a timesheet to track hours worked to ensure compliance. Some of the common things your child can do around the office are filing, helping to promote your medical practice, cleaning, answering phones, taking notes, or setting appointments.

Whatever tasks you choose to have your child perform, their duties should be discussed and documented in their employee file. And when it comes to payday, your child should be included in your payroll and paid on the same schedule as your other employees.

Income Tax Benefits

Employing your child is just like employing any other individual, with a few exceptions. Suppose you operate as a sole proprietor, single-member LLC, or a partnership in which all partners are the child’s parents, and the child is under the age of 18. In that case, you will need to withhold income taxes, but the child is not subject to social security and Medicare taxes. However, if your child is 18 years or older, the wages would be subject to social security and Medicare. If you operate as a corporation or an S-Corporation, the child’s wages will be subject to employment taxes regardless of age.

Additionally, your child will be exempt from Federal income tax for the first $12,950 of earnings (in 2022), while you get a tax deduction for paying them. Depending on your marginal tax bracket, you may save $2,500 – $4,000 plus per year in income taxes—a nice added benefit for working with your child and teaching them life skills.

What Should My Child Do with the Paycheck?

A common concern amongst physicians is that they are reluctant to give their children all this money. We recommend opening a bank account in the child’s name to deposit their paychecks. Rather than having their check conveniently deposited electronically, pay them by paper check so they can have the experience of walking into the bank and working with a teller.

Secondly, have your child begin to pay for some expenses you usually cover, such as clothes, meals, or activities. This will help them learn to budget their own money and understand the cost of such items.

Third, have your child save some money for future schooling needs.

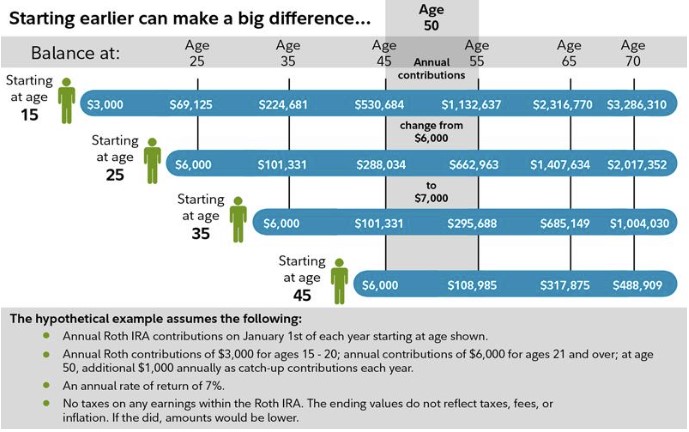

Finally, have your child contribute some money to their Roth IRA. Since your child is in the zero or lower tax bracket, it makes sense to contribute to a Roth IRA and get tax-free accumulation over their very long lifetime. It is almost certain they will be in a higher tax bracket later in life.

Below is a chart from Fidelity Investments showing the value of contributing early in life to a Roth IRA.

At Rx Wealth, we work with you to coordinate your child’s employment and other areas of your financial life. To schedule a free consultation, please contact us or schedule your consultation here.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.