By Chris J. Roe, CPA, PFS

The inflation we saw in 2022, along with the steps the Fed has taken to curb it, has put a strain on everyone’s wallets. But a silver lining we can look forward to in 2023 is higher contribution limits for our retirement accounts.

The IRS recently released 2023’s contribution limits, so you can begin incorporating the changes in your financial plan to make the most of your savings opportunities. Here’s a rundown of the updated figures.

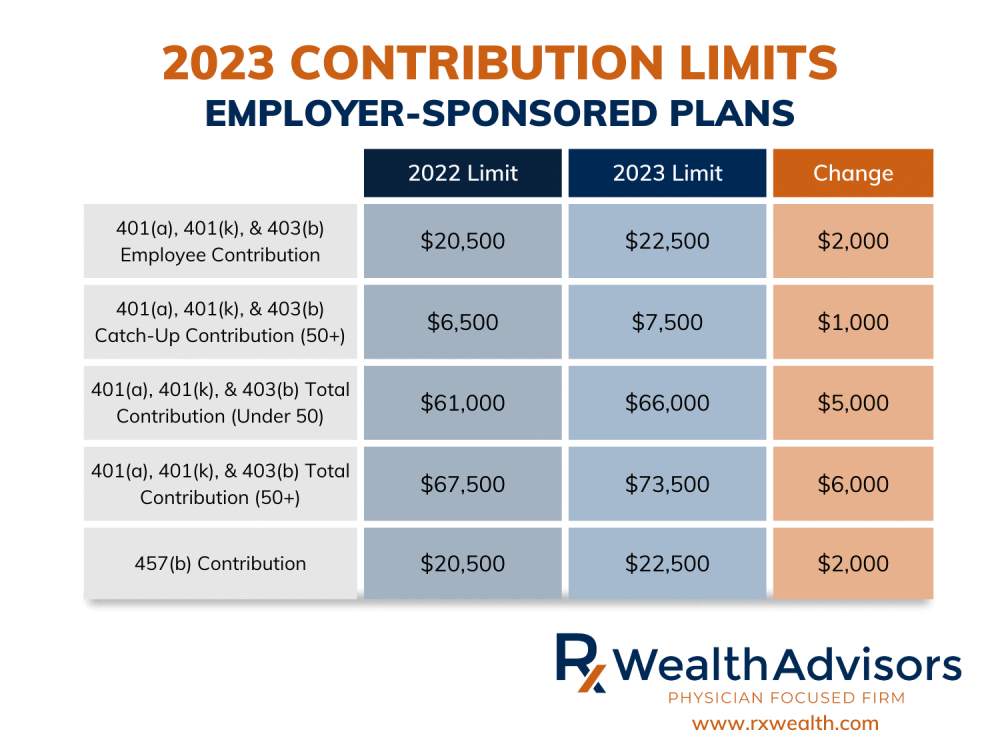

Employer-Sponsored Plans

401(a), 401(k), and 403(b) Employee and Total Contribution Limits

The employee contribution limit for 401(a), 401(k), and 403(b) retirement plans is $22,500 in 2023. If you are over 50 years of age, you can contribute an additional $7,500, an increase of $1,000 over 2022. Thus, total contributions for individuals over age 50 are $30,000.

For 2023, all employee/employer contributions will increase to $66,000, and for individuals over age 50, $73,500.

If you are lucky to participate in both a 401(a) and 403(b) plan, a maximum of $66,000 can go into each plan—a nice tax loophole.

The 401(a) compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase to $330,000 in 2023.

457(b) Contribution Limit

The 457(b) contribution limit for 2023 is $22,500. These plans have unique catch-up contribution rules, so consult with your plan administrator if you want to put more in yours.

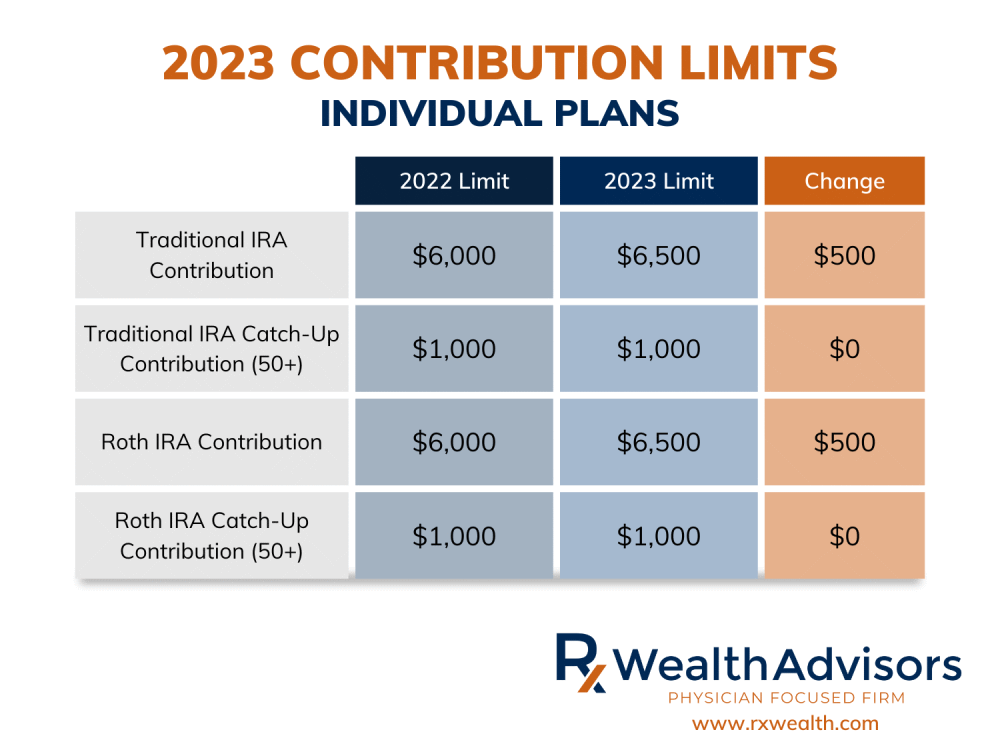

Individual Plans

Traditional & Roth IRA Contribution Limits

For 2023, the IRA contribution limit will increase to $6,500 ($7,500 if age 50 or older).

The IRA deductibility phaseout for those with a retirement plan at work is:

- For single taxpayers: $73,000-$83,000

- For married filing jointly taxpayers: $116,000-$136,000

- For taxpayers not participating in a plan but with a spouse who is: $218,000 to $228,000

Roth IRA contributions are available to single taxpayers with a modified adjusted gross income (MAGI) between $138,000-$153,000 and married filing jointly taxpayers between $218,000-$228,000. If your MAGI exceeds these limits, you will need to contribute indirectly via a backdoor Roth Ira.

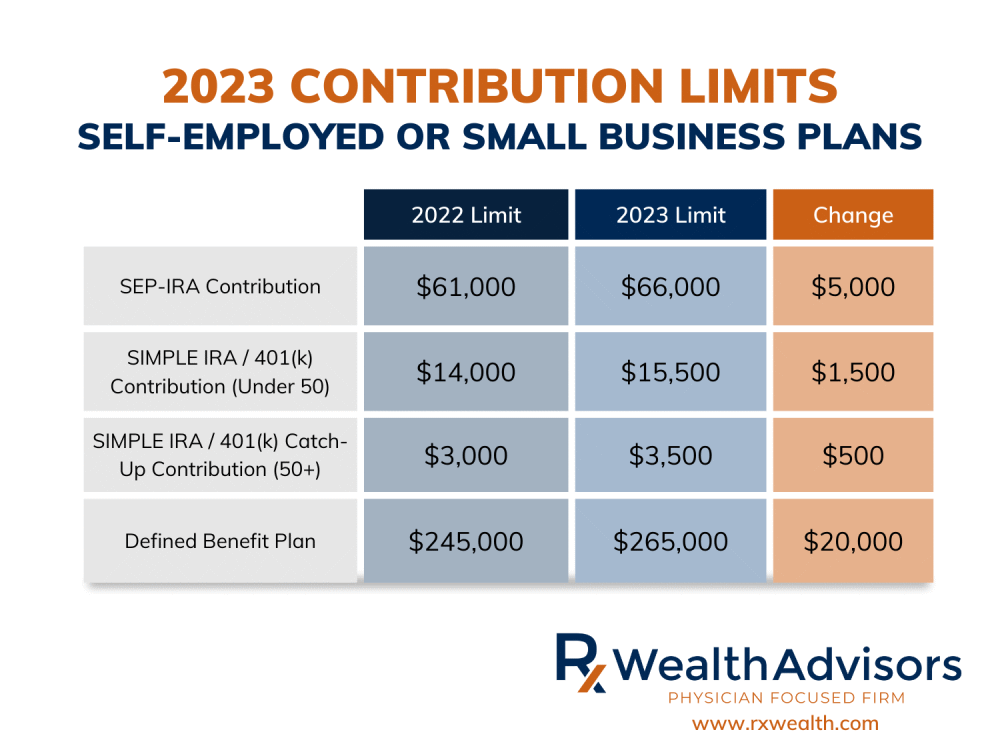

Self-Employed or Small Business Plans

SEP IRA Contribution Limit

SEP contribution limits increase to the lesser of 25% of employee’s compensation, or $66,000 for 2023. SEP IRAs do not have an over-age-50 catch-up contribution. If you are looking to contribute over $66,000 and are over 50, you should consider alternative retirement plans.

SIMPLE IRA & SIMPLE 401(k) Contribution Limits

The SIMPLE IRA and SIMPLE 401(k) contribution limits will increase to $15,500. Taxpayers over age 50 can contribute an additional $3,500, for a total of $19,000 for this group.

Defined Benefit Plans

The defined benefit plan limit will increase to the lesser of 100% of your average compensation for the highest three consecutive years or $265,000.

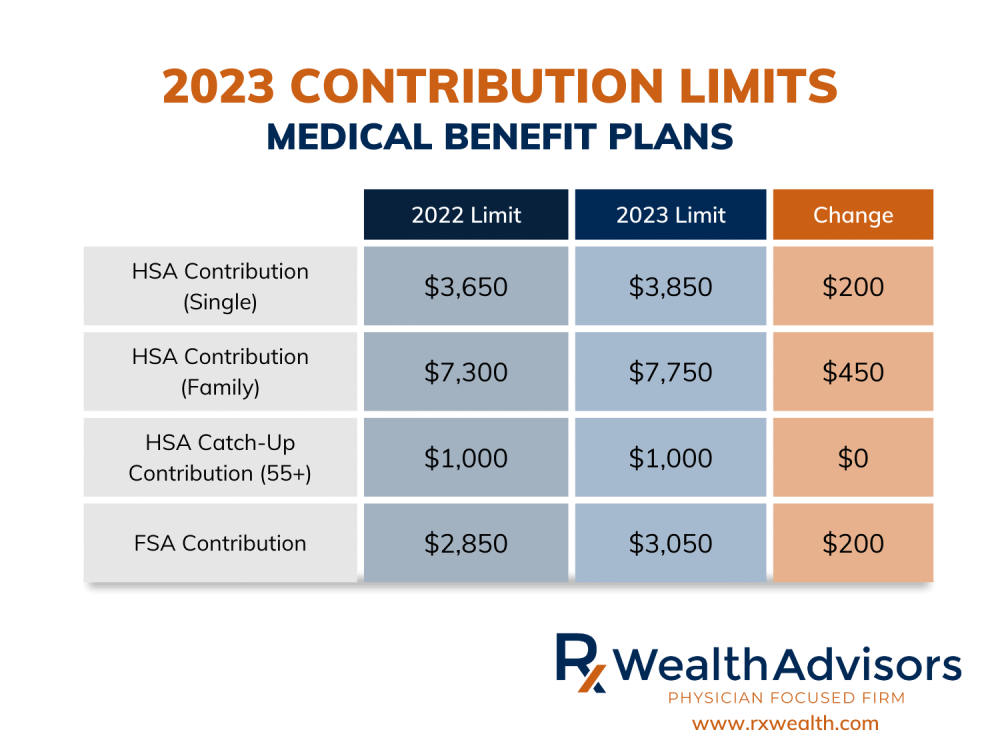

Medical Benefit Plans

Health Savings Account (HSA) Contribution Limit

In Revenue Procedure 2022-24, the IRS confirmed that for 2023, the health savings account (HSA) contribution will increase to $3,850 for single people and $7,750 for families. If you are over age 55, you can contribute an extra $1,000.

HSAs are an underutilized strategy for long-term wealth building that allows taxpayers to receive a tax deduction upfront, tax-deferred growth, and tax-free withdrawals in the future when medical expenses are incurred. This year’s increase is generous, so take advantage of it to the fullest.

Flexible Spending Accounts (FSA) Contribution Limit

For 2023, you can contribute $3,050 to a flexible spending account (FSA), an increase of $200 over 2022.

It is important to know the contribution limits for your retirement accounts and consult with a financial advisor or tax advisor, like Rx Wealth, to make the most of your savings opportunities. By taking advantage of the contribution limits and planning carefully, you can ensure that you are making the most of your retirement savings and working towards a financially secure future.

Rx Wealth Advisors is a physician-focused financial advisory firm. Their primary focus is to help medical doctors maximize their earnings, keep more money in their pocket, and cultivate wealth so they can live the life they’ve earned and deserve. Rx Wealth can be reached at 412-227-9007, via email at croe@rxwealthadvisors.com, or on the web at rxwealthadvisors.com.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.