By Chris J. Roe, CPA, PFS

As many high-net-worth professionals are aware, the US Government taxes long-term capital gains (gains on capital assets held for over a year) at a lower income tax rate (0-20%) compared to other income sources such as wages, business income, or interest. However, the complexities of capital gains taxation and their interplay with ordinary income are often misunderstood.

The Impact of Capital Gains on Ordinary Income

Recognizing capital gains in any tax year may result in a higher overall income tax on ordinary income. In other words, your wages, IRA distributions, Social Security, or interest income could be subject to a higher tax rate if you have capital gains. When considering the sale of a business, real estate holdings, or realizing stock incentives, it is crucial to plan ahead and account for the effect that capital gains will have on your income taxes.

The interaction of capital gains with ordinary income in determining your tax rate can be intricate and requires proactive management. Fortunately, numerous planning opportunities are available, but preparation and foresight are essential to maximizing their effectiveness. Realized capital gains increase your adjusted gross income (AGI), which may affect your ability to make Roth IRA or tax-deductible contributions, reduce available tax credits, and increase the hurdle for claiming medical expenses, among other consequences.

While capital gains influence certain tax benefits, long-term gains are taxed at a lower rate than ordinary income and do not push you into a higher marginal tax bracket. However, it is essential to remember that short-term gains are taxed at ordinary rates. Realized long-term capital gains do not force your ordinary income into a higher marginal tax bracket. Still, they may result in higher taxes due to reductions in available tax deductions and tax credits.

However, if you know how to navigate the numerous capital gains deferral or elimination opportunities, you can save a lot of dough.

Planning Opportunities for Capital Gains

Paying a 0% or 15% Capital Gains Rate

In 2018, the tax code was updated to introduce a 0% tax rate on long-term capital gains for taxpayers in the 12-22% tax bracket. In our experience advising clients, individuals who typically fall within this bracket are either less wealthy parents or adult children beginning their careers. It is important to note that dependent children are generally excluded from this provision, as they are typically required to pay taxes at their parents’ rate.

When planning for a significant capital gain event, it could be strategically advantageous to gift an interest in the asset to your parents or adult children, as this may result in an overall lower capital gains tax liability.

Stepping Up Your Income Tax Basis Before a Sale

If you anticipate a substantial capital gain event and have aging parents or grandparents who may pass away before the event occurs, it is possible to strategically achieve a step-up in basis on the asset. One approach is establishing a trust for your spouse, children, and aging family members.

By setting up the trust and granting your aging relatives a general power of appointment within the trust to allocate assets to the creditors of their estate, you cause the assets to be included in the elder’s taxable estate. As a result, these assets qualify for a fair market value step-up on basis upon their passing.

Consider this example: Sammy Business Owner establishes a trust for his wife, children, and 98-year-old grandmother and gives $5 million worth of company stock with a $100,000 basis to the trust. The trust provides Sammy’s grandmother with a general power of appointment to allocate assets upon her death to the creditors of her estate. Upon her passing, the company stock’s basis increases to $5 million, up from $100,000. This strategic move saves Sammy and his family a cool $1.1 million in taxes.

Moreover, Sammy retains access to the funds in the trust, as his wife is a beneficiary.

Deferring the Capital Gains through an Installment Sale

It’s still possible to sell your stock or other assets to a trust for your family’s benefit and receive a promissory note in return. The note may require principal and interest payments over an extended period, such as 10, 20, or 30 years. With each installment payment you receive, you’ll recognize a partial capital gain.

Selling the asset is considered a taxable transaction, so the trust purchasing the asset receives a stepped-up basis. Consequently, when the trust sells the asset, it generally experiences little to no gain. As you might imagine, the IRS wasn’t fond of this transaction and attempted to eliminate it. However, they only partially succeeded.

These transactions remain viable, but they do require advanced planning. If an installment sale occurs between related parties and the related party sells the asset it purchased within two years, the transaction is unwound and deemed to have occurred on the date of the initial installment sale.

As you can see, to make this strategy viable, you must plan more than two years in advance. In our experience, the more time you have to plan, the better the outcome.

Using a Like-Kind Exchange

If you’re selling investment real estate, you can exchange it for like-kind property of generally greater value and defer the gain. Keep in mind, however, that the exchanged property must be like-kind and held for investment purposes, not a personal residence such as a beach house or ski lodge.

For example, Johnny Real Estate owns an apartment building he built 30 years ago with a $0 basis. He wants to sell it because he has an opportunity to purchase another apartment building he believes will appreciate faster. By performing an exchange, Johnny can defer the capital gains tax. This transaction is subject to a complex set of rules and requirements, so it’s essential to consult with professionals before proceeding.

It’s worth mentioning that the Biden Administration has proposed eliminating the like-kind exchange from the tax code in their recent budget proposal.

Using Charitable Trusts to Create Installment Sale Treatment

Similar to deferring gains through an installment sale, you can establish a charitable trust that makes lifetime payments to you and your spouse.

When you give appreciated assets to the trust, you’ll be entitled to an income tax deduction for the portion considered a charitable contribution. Then, on an annual basis, you’ll receive income from the trust, a portion of which will be taxed as a capital gain.

The downside of this strategy is that if you and your spouse pass away early, any remaining assets in the trust will go to a charity of your choice instead of your heirs. To address this concern, consider supplementing the trust with 10-20 year term life insurance. In the event of an early death, your family will receive life insurance proceeds to replace the assets given to charity, ensuring their financial well-being.

Opportunity Zone Investing

In 2018, Congress passed legislation enabling the investment of capital gains into Opportunity Zones (i.e., real estate). By investing your capital gains in these zones, you can defer gain recognition until 2026. Moreover, if you hold the asset or fund for 10 years, your gains from the fund are taxed at 0%.

Opportunity Zones offer a straightforward method for capital gain deferral, but we advise against allocating a large portion of a family’s wealth to these investments solely for deferral purposes. Your money will be locked up, concentrated in real estate, and exposed to operator risk.

Active Tax Loss Harvesting

Actively harvesting tax losses in your liquid investment portfolio can help offset gains realized from a significant sale. Your investment advisor should proactively build up a tax loss reserve in preparation for when large gains are recognized.

Furthermore, when a sizable sale occurs and funds invested, short-term losses may arise. These losses can also be harvested, provided they occur within the same tax year.

Using Tax-Deferred Accounts for Gains

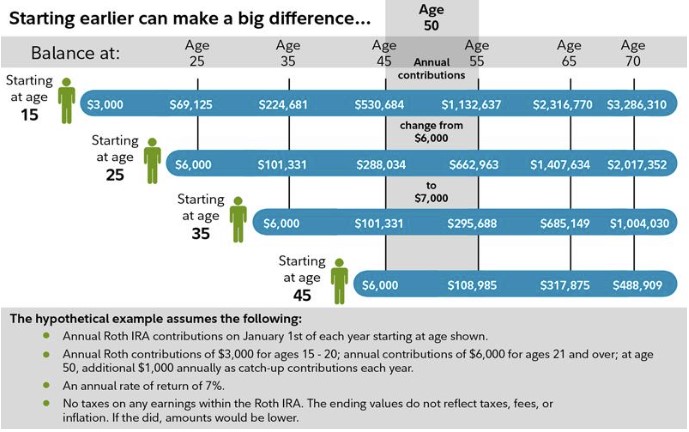

If you plan to invest in certain assets expected to appreciate rapidly, consider doing so within your Traditional or Roth IRA. For instance, if you’re investing in a startup company that you expect to soar, you can purchase their common shares within your IRA.

A Forbes article recently highlighted how Peter Thiel, PayPal co-founder, grew his Roth IRA to $5 billion using this technique to invest in startups.

However, be cautious, as these transactions have many rules, and the last thing you want is for the IRS to say you entered into a prohibited transaction, disqualifying your IRA. This can be a significant tax trap for the unwary.

It’s worth noting that the Biden Administration has proposed mandatory large distributions for what they consider “Large IRAs.”

Plan Ahead and Consult with Professionals

Whether you plan to sell this year or are contemplating the sale of a substantial asset in the future, it’s crucial to consult with professionals and develop a strategic plan as far in advance as possible.

If you’re interested in a free initial consultation and considering selling a business or large asset, please don’t hesitate to reach out and schedule a time.

Rx Wealth Advisors is a physician-focused financial advisory firm. Their primary focus is to help medical doctors maximize their earnings, keep more money in their pocket, and cultivate wealth so they can live the life they’ve earned and deserve. Rx Wealth can be reached at 412-227-9007, via email at croe@rxwealthadvisors.com, or on the web at rxwealthadvisors.com.